Withholding Tax Invoices in Oracle AP:

Withholding tax (WHT) is the amount withheld while making a payment to a supplier/contractor/any payee. Instead it is paid to the tax authorities.

You may be required to withhold taxes from your employee expense reports and supplier invoices. Payables lets you to automatically withhold tax based on the certain conditions you specify in Withholding Tax region of the Payables Options window.

We will now cover the steps required to automate the Withholding tax processing.

Pre-Requisites:

1. Enable Withholding Tax option:

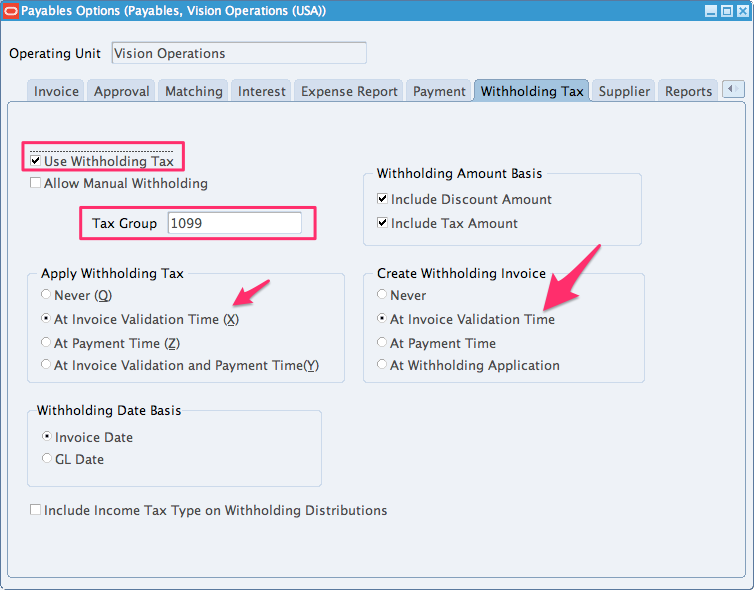

Navigation: Payables Responsibility > Setup > Options > Payables Options > Withholding Tax tab

a.Tick the Check box “Use Withholding Tax.

b.Enter Tax Group name. This is optional

c.Under Apply Withholding Tax section, you will specify at what point of time, the tax should be withheld.

d. Under Create Withholding Invoice section, you will specify when Withholding invoice will be created.

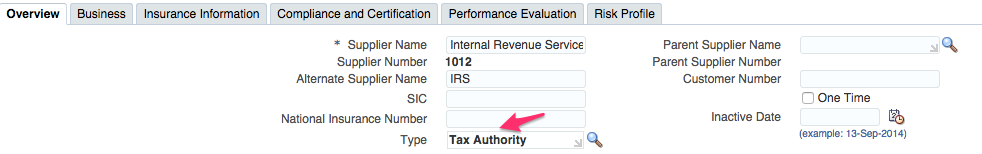

2. Define your Tax Authority as a Supplier.

Navigation: Payables Responsibility > Suppliers > Entry

Create Tax Authority as Supplier along with the necessary sites.

The Tax Authority has to be setup as a supplier with a supplier type “Tax Authority”. Atleast one supplier site for the Tax Authority needs to be setup as well.

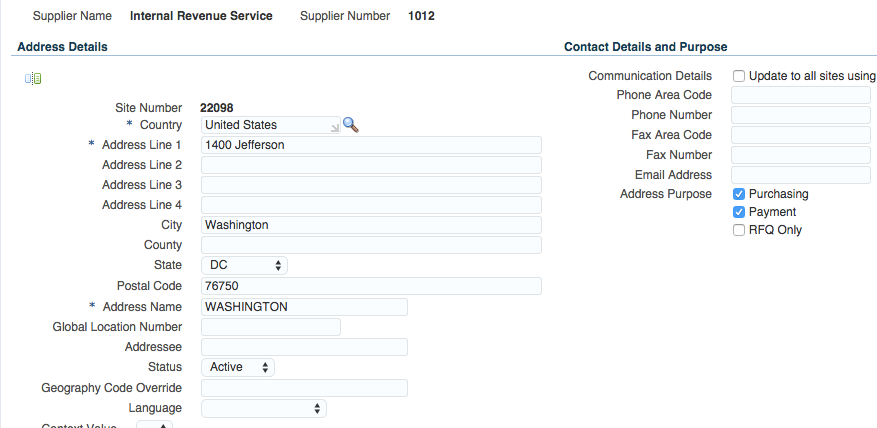

Site:

Under Tax details tab, enter the below:

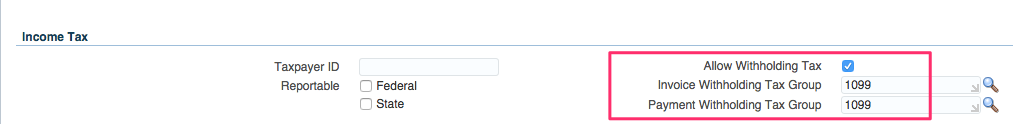

a.Allow Withholding Tax: Check “Allow Withholding Tax” Check box. This can set either at the supplier level or the supplier site level.

b.Invoice Withholding Tax Code: Enter the WTH tax code. If you have not created yet, come back and enter once it has been created.

c.Payment Withholding Tax Code: Enter the WTH tax code. If you have not created yet, come back and enter once it has been created.

Optional Components for the Tax Authority setups are:

A unique Pay Group (so you can separate the payments to the Tax Authorities from the other payments)

A payment format that uses the Tax Authority Remittance Advice as its Separate remittance Advice

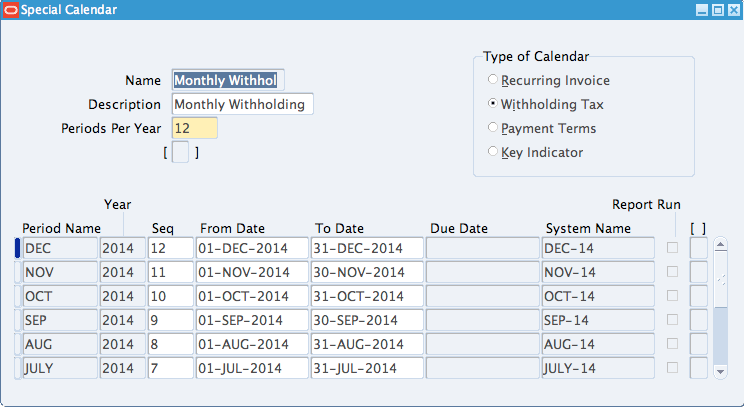

6. Define withholding Tax calendar.

In order to automate withholding tax, we need to define periods using the special calendar if you choose Period Limit

Navigation: Payables Responsibility > Setup > Calendar > Special Calendar

a. Name: Enter a unique name for this calendar.

b.Description: Enter a meaningful description

c. Periods per year: Enter how many periods you wish to have in your calendar. Eg: 12,8, 4 etc.

d. Type of Calendar: Choose Withholding Tax

e.Periods: Define your periods, their names , start date and end date for a period.

Save the work.

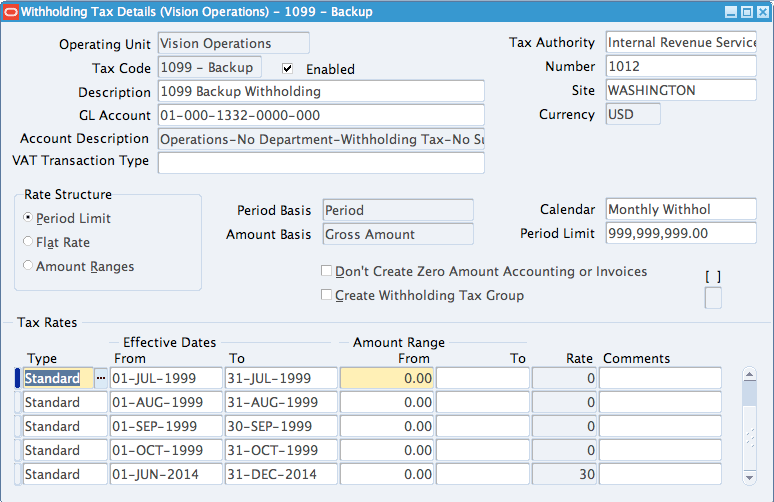

2. Withholding Tax Code Setup.

Navigation: Payables responsibility > Setup > Tax > Withholding > Codes

a. Operating Unit: Enter the Operating unit

b.Tax Authority and Site: Enter Tax Authority that you have created in Step 2 and its supplier site.

c. Tax Code: Give a unique name

d. Description: Enter a meaningful description

e. GL Account: Enter the GL Account that should be used to hold the withheld amount

f. Rate Structure:

Period Limit: Choose this option, if you want to have a limit on the amount withheld during a withholding tax calendar period. Once withheld amount exceeds this limit, Payables will not withhold anymore.Also it’s mandatory to enter the Withholding Tax calendar and period limit fields if you choose Period Limit option.

Amount Range: Choose this option, when your WHT rate depends on what you already have paid during a time period. For the amount basis you can choose between Gross Amount and Withheld Amount. The time period is either per withholding tax calendar period or per invoice.

Flat Rate: Choose this if have no amount limit or period limit.

g. Tax Rate: Define the tax rates for each day.

Save the work.

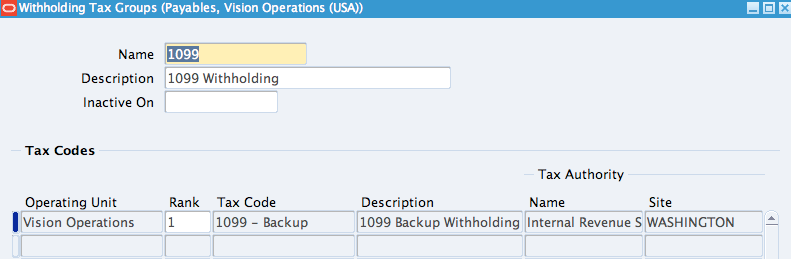

3. Withholding Tax Group Setup

In the Withholding Tax Groups window you can add multiple Withholding Tax Codes to a group. WHT codes can be assigned to more than one group.

If this is used, Payables calculates invoice withholding tax based on every tax code in the withholding tax group (Based on the ranking).

Because you can only apply Withholding Tax Groups to an invoice (and not an individual Withholding Tax Code) you have to create a Withholding Tax Group even if it only applies to one Withholding Tax Code. You can enforce this by clicking the Create Tax Group field in the Withholding Tax Code form.

Payables>>Setup>>Tax>>Withholding>>Groups

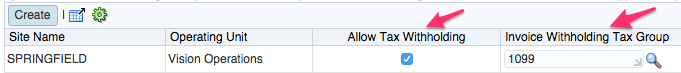

5. Define WHT on Supplier / Supplier Site for standard suppliers

Navigation: Payables Responsibility > Suppliers > Entry

Query for the supplier that you want to withhold the amount and go to Tax Details tab.

Check “Withholding Tax” Checkbox and enter the Withholding tax group at Supplier and site level.

Steps to create Withholding Tax automatically:

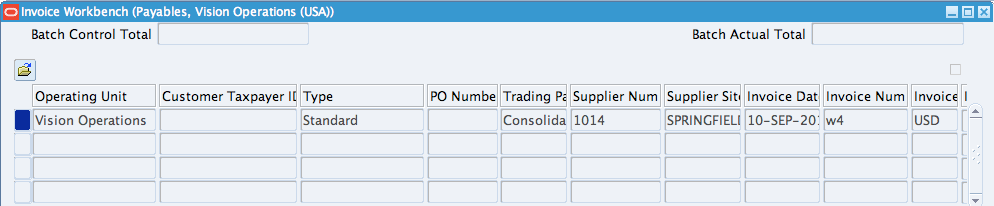

Create a Standard Invoice in AP.

Navigation: Payables responsibility > Invoices > Entry > Invoices

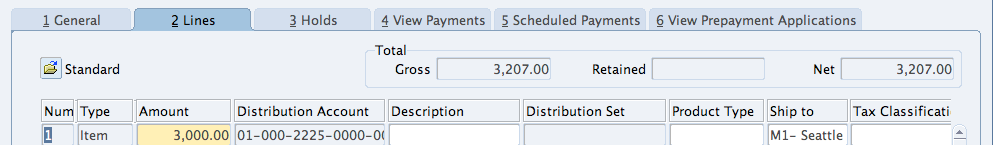

Enter the header details and line details and save.

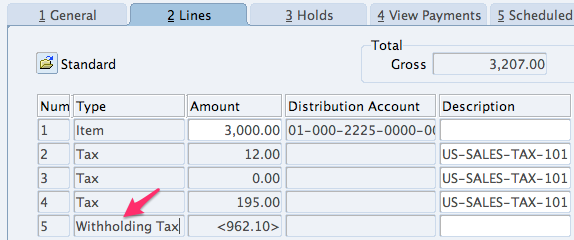

Validate the invoice by going to Actions button > Validate.

If you remember, we have setup in such a way that whenever an invoice is validated, the withholding amount will be generated.

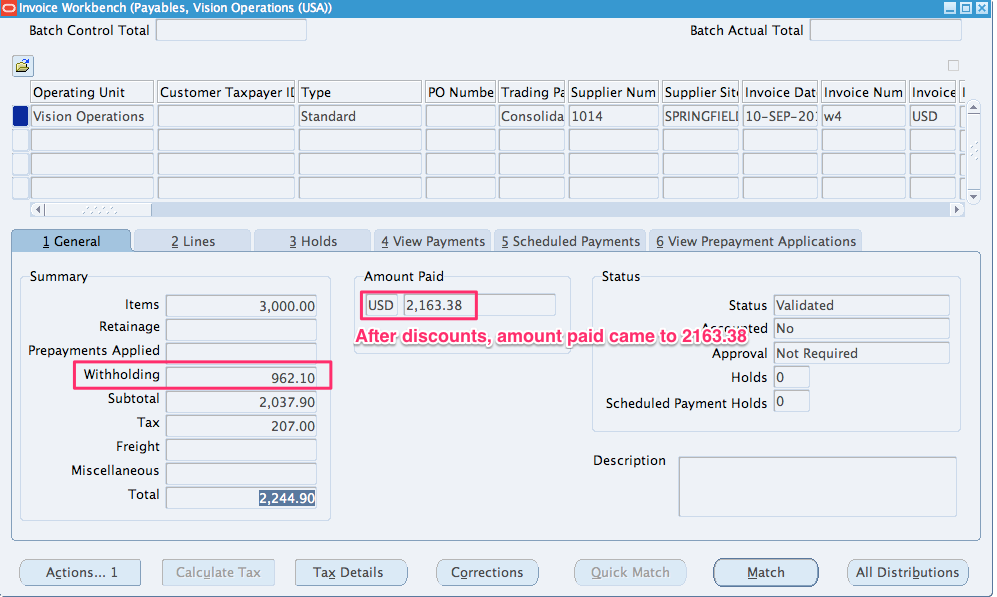

Now if you go back to the lines, you will notice an additional line with type Withholding Tax. Rate defined in Tax Code screen will be withheld.

Now you can create accounting for the same and make the payment. You will only have to pay $2240.90 because 20% will be paid to tax authority and has been withheld from being paid to the supplier.

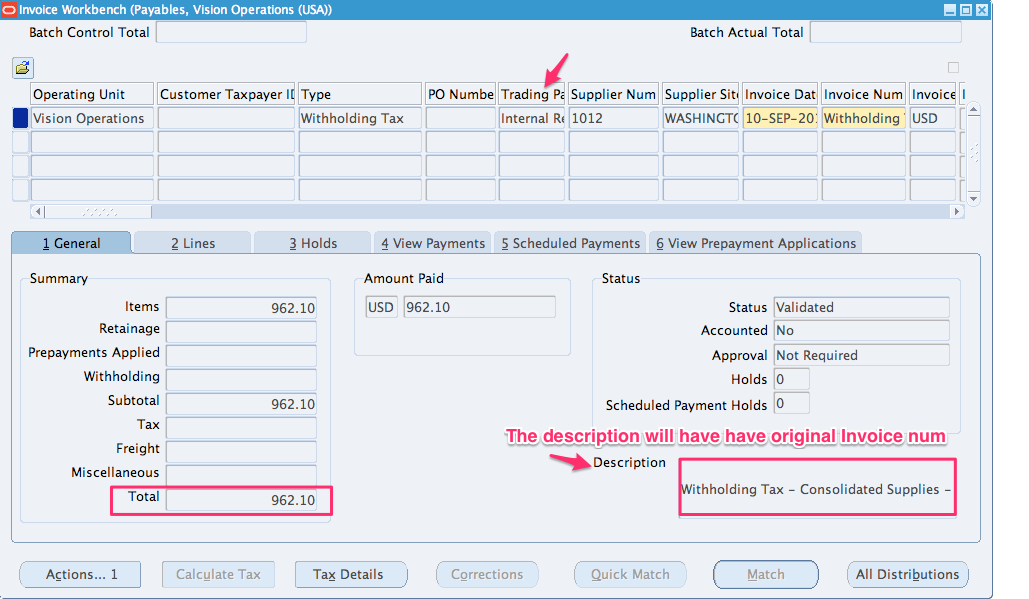

At the same time, a new invoice with type “Withholding Tax” will be created with the same amount as the one it has withheld in the invoice “w4”.

If you notice, the supplier will be a tax authority that we have created above. Description will have the original invoice number.

You can validate , create accounting and make a payment for this invoice as well.