Chargebacks in Oracle Receivables:

You create Chargebacks when you wish to close the original invoice which the customer has partially paid and create a new invoice for the remaining amount that the customer has to pay yet.

For example, your customer sends payment of $75 for a $100 invoice. You can apply the receipt to the invoice, then create a chargeback for the balance due.

Chargeback Cycle:

• Create Invoice for the goods that the customer has bought.

• Upon receiving the payment (which in our example is partial) from customer, create receipt

• Apply the receipt to the invoice

• Create Chargeback for the remaining amount that the customer has to pay (this will get the balance of the original invoice to ZERO)

• Later when the customer pays the remaining amount, create a receipt and apply it to the chargeback.

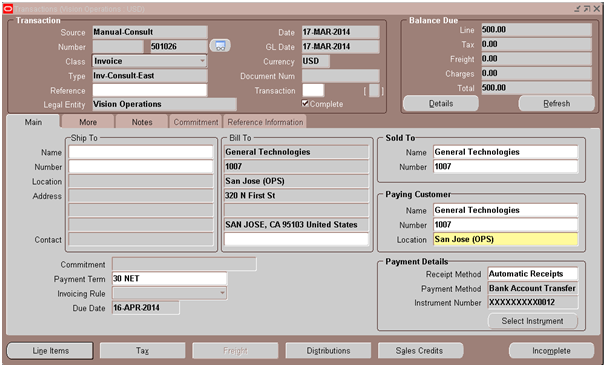

1. Create Invoice: Say a customer bought a camera worth $500 from us. You will create invoice for $500 for that customer.

Click here to get detailed information on how to create invoice

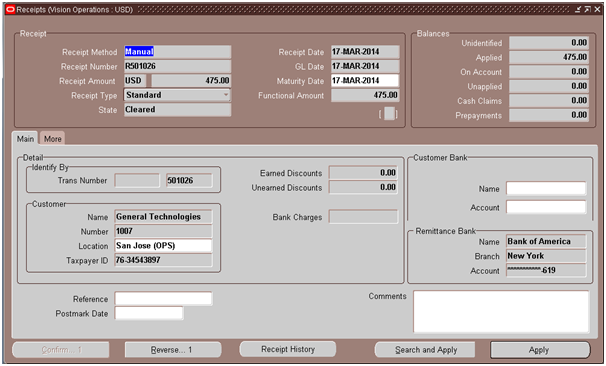

2. Create Receipt: Customer sent payment of $475 instead of $500. Once you receive the payment, you will create a receipt for $475.

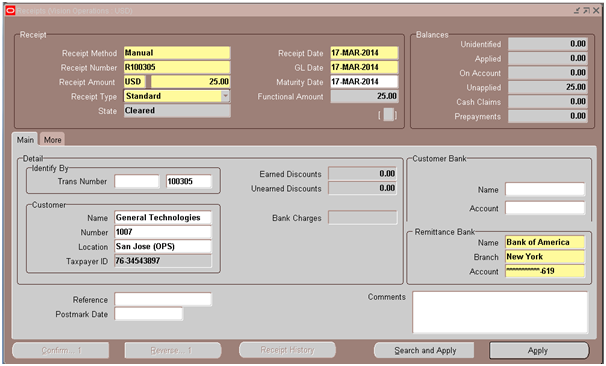

Navigation to create a receipt: Receivables responsibility > Receipts > Receipts

Enter the below information:

Receipt Method: Choose one of the options in the drop down depending on how and to which bank account you received the payment.

Receipt Number: Enter a meaningful and unique receipt number

Receipt amount: Enter the amount paid by the customer

Trans Number: Enter the transaction (invoice) number for which the customer has sent the payment. This will automatically populate the customer information.

Save the work. This will create the receipt.

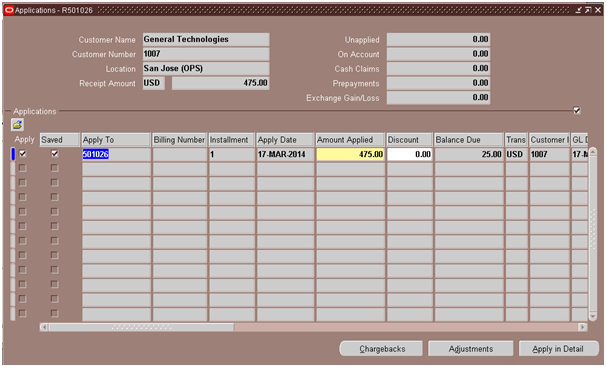

3. Apply the receipt to the invoice to get its balance down.

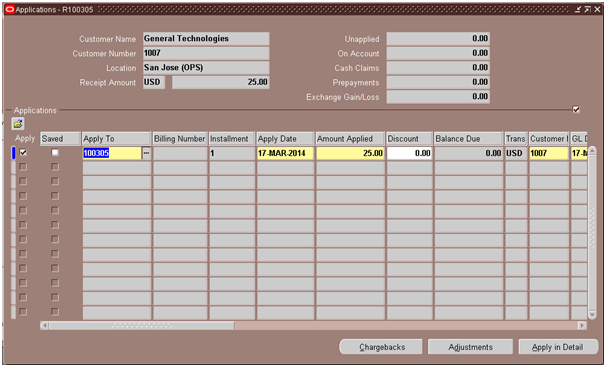

To apply a receipt to invoice, click on Apply button in the receipt workbench.

Enter the invoice number to which you want to apply the receipt to in the Apply To field and save the work. (Make sure Apply check box is checked before saving)

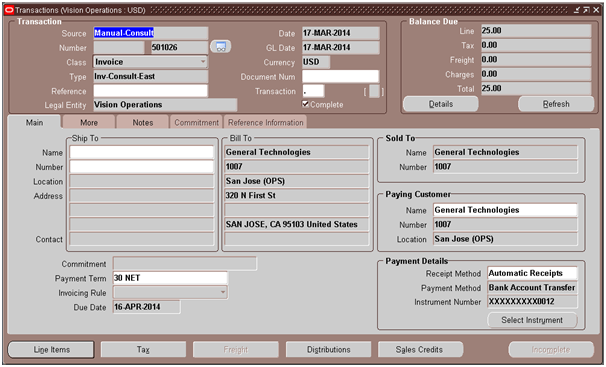

After applying, the balance on the invoice is $25.

4. Create Chargeback: In order to close this invoice and to create a new one with the amount $25 (customer has short paid), we will create chargeback.

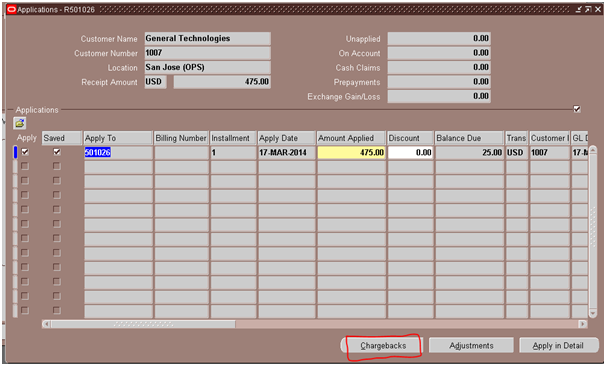

Go to Receipts workbench and query our receipt and click on Apply button

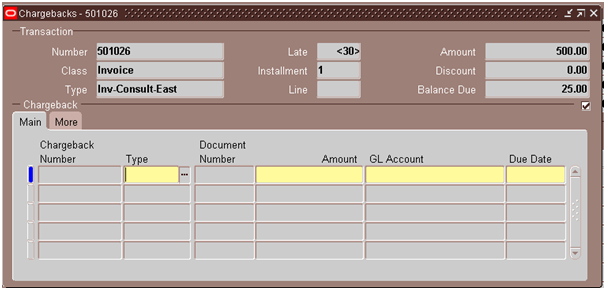

Now click on Chargebacks button

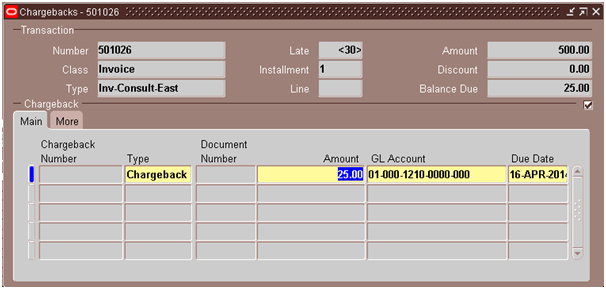

Enter the transaction Type and the Amount of this chargeback. The default chargeback amount is the remaining amount of the transaction.

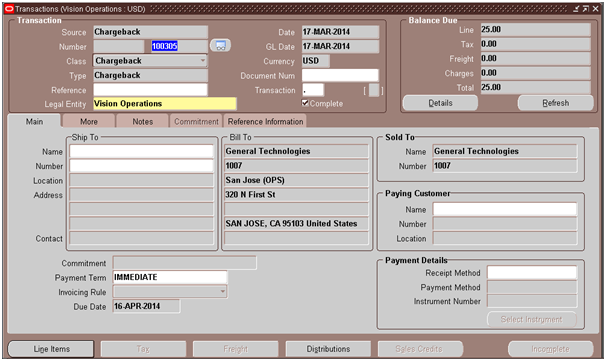

Save the work. Upon saving, the chargeback number 100305 will be automatically be generated.

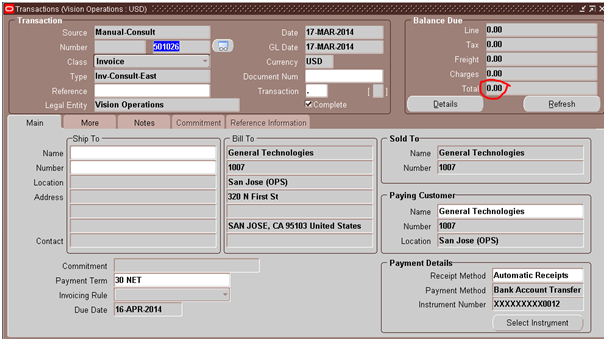

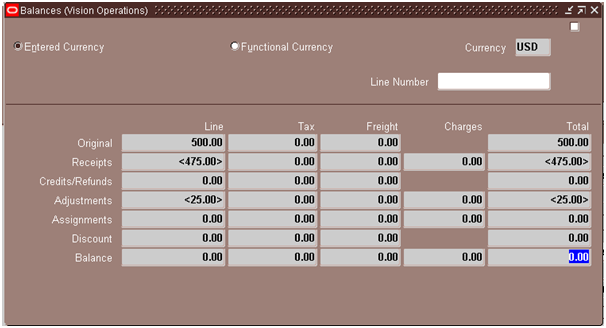

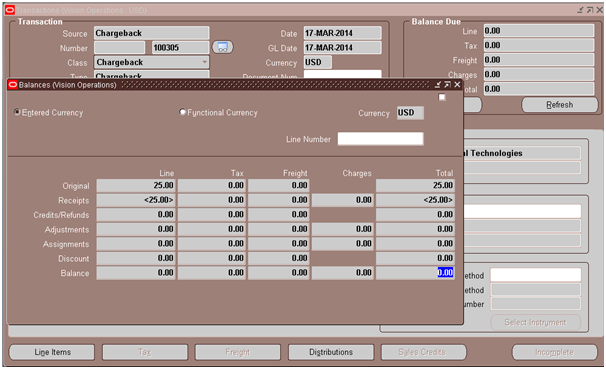

Check the balance on invoice, it should be $0

Now query the Chargeback. You will see a balance of $25 which the customer has to pay.

5. Create Receipt for the remaining payment: Once the customer sends us the payment of $25, you create a receipt for $25.

6. Apply Receipt to Chargeback: Now apply the receipt to the chargeback by clicking APPLY button. This will bring down the balance on the chargeback to $0.

Save the work.

Let’s check the balance on the chargeback which should be $0.