Retainage Release Invoices in Oracle AP:

Retainage means retaining certain amount of money with us without paying the supplier in full. The retained amount is released or paid to the supplier when all the terms of the agreement have been met or all the work is completed.

Pre-requisites:

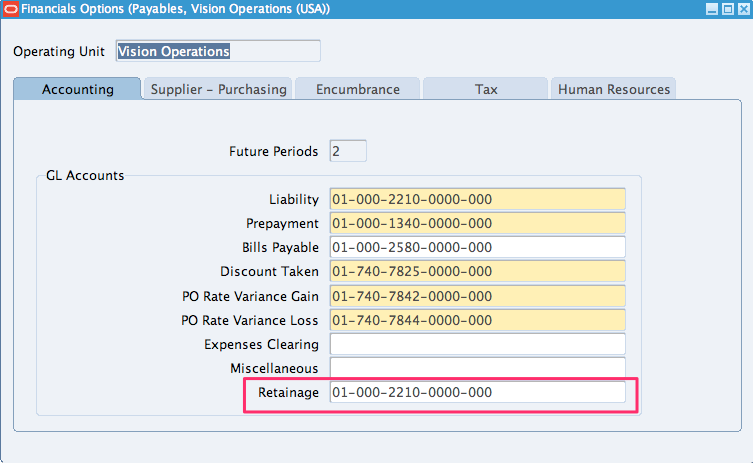

1. Retainage Account setup:

Navigation: Payables Responsibility > Setup > Options >Financials Options

Under Accounting tab, make sure you define the Retainage Account.

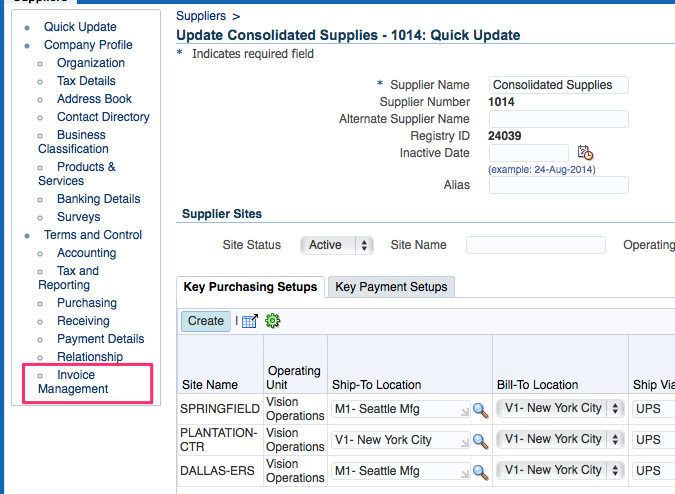

2. Define the retainage rate for the supplier.

Navigation: Payables Responsibility > Suppliers > Entry

Query for the Supplier and go to Invoice Management Tab

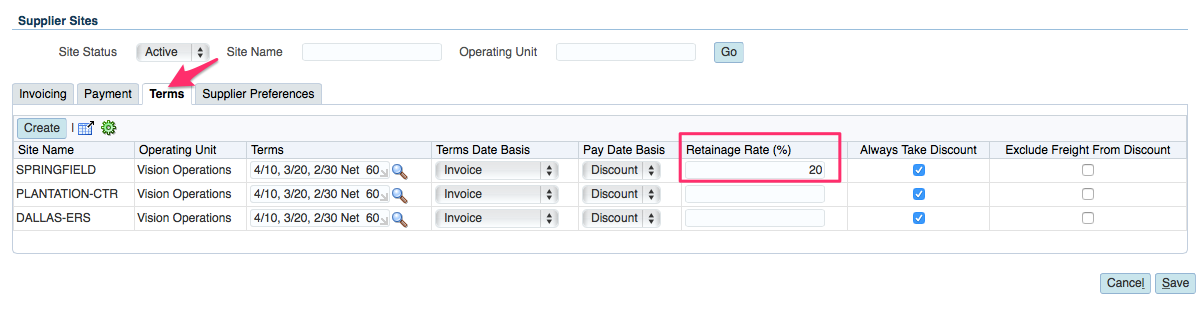

Under Terms tab, enter the retainage percentage for the desired site and save.

Steps to create and release retainage:

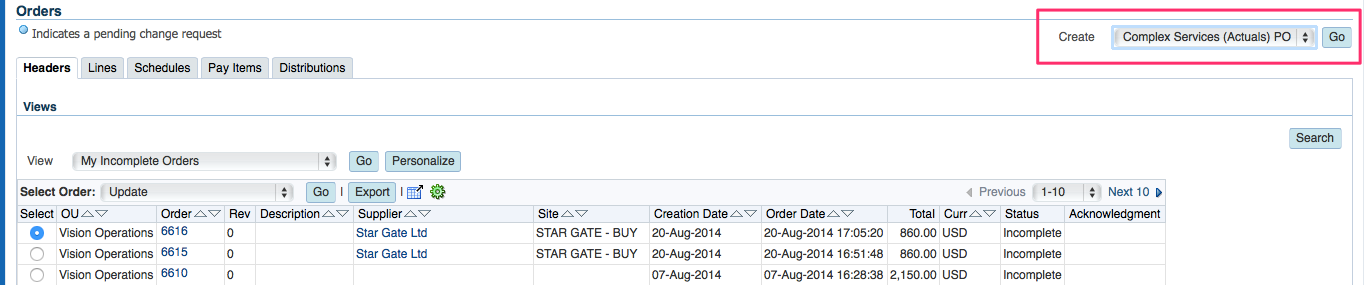

1. Create Complex PO:

Navigation: Purchasing Responsibility > Buyer Work Center > Orders

Choose “Complex Services (Actuals) PO from the LOV next to Create field and click on go.

Enter the below details:

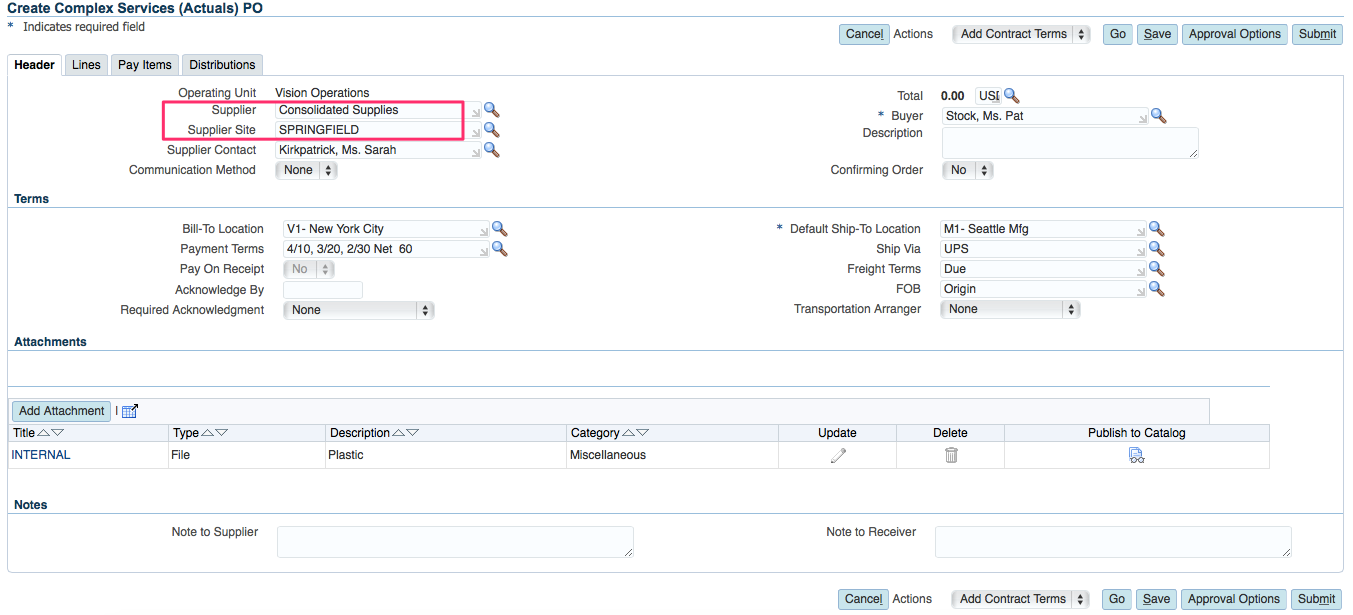

Under Header Section: Enter Supplier and Supplier Site

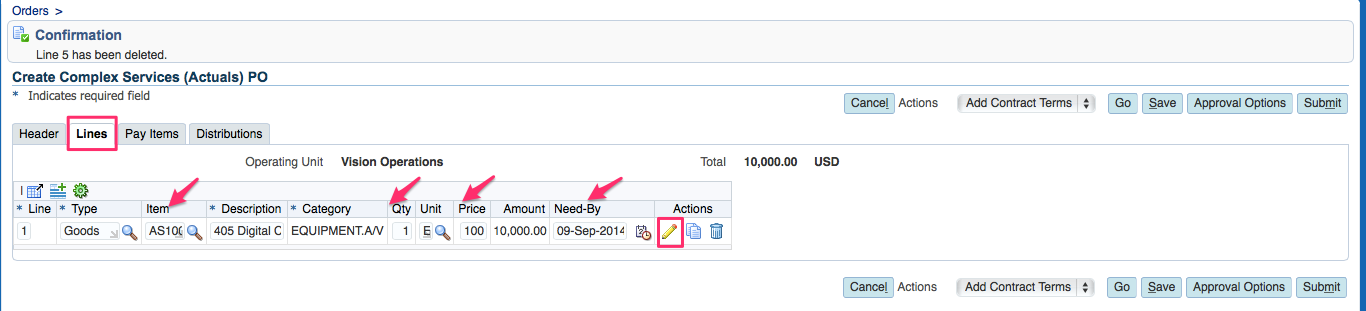

Under Lines Tab: Enter Item, Qty, Price and need by date.

Delete the additional blank lines and save.

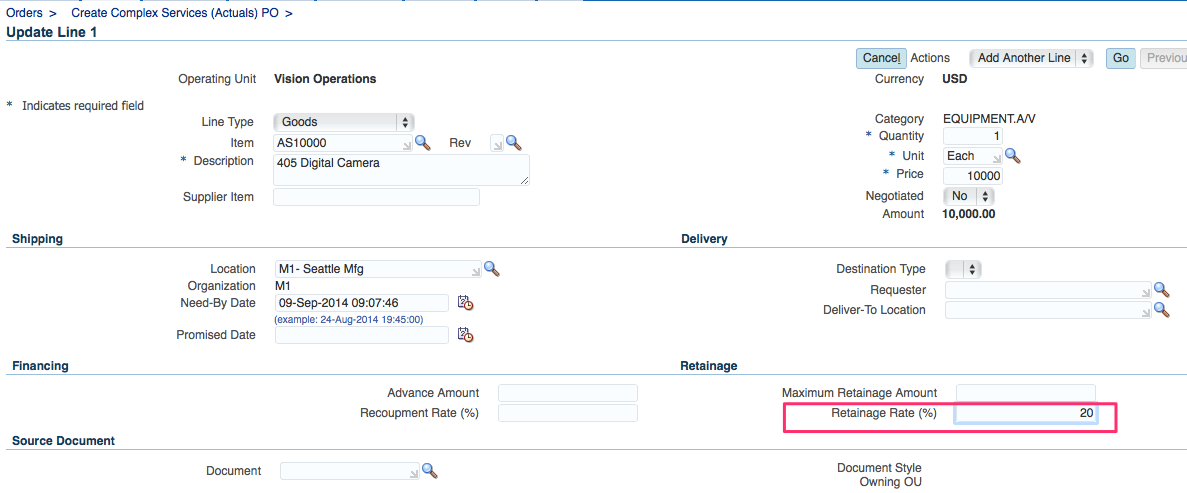

Next click on Update icon. If you have not defined the retainage percentage at Supplier site level, you can set it now. Based on the percentage defined here, the respective amount will be retained. You can also specify Maximun retainage amount here which means retained amount cannot exceed the amount specified here.

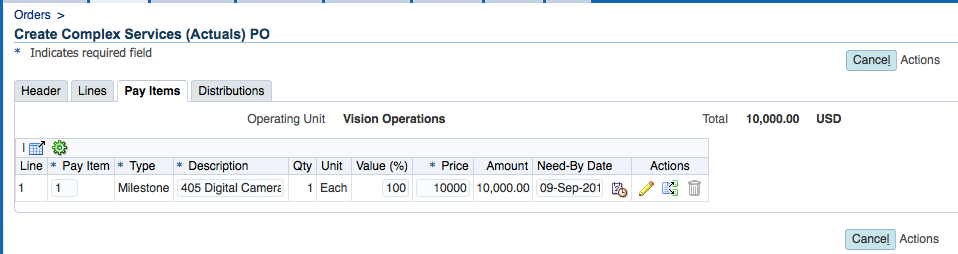

Under Pay Items tab: Enter the Value (%).

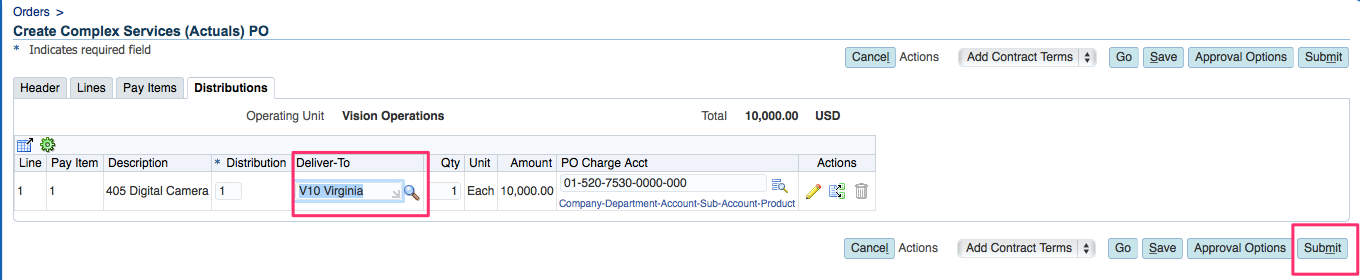

Under Distributions Tab: Enter Deliver to location.

Click on Submit.

Complex PO 6621 has been successfully created.

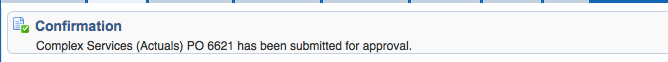

In the Views dashboard, search for “My Open Orders” and make sure your order is Approved.

2. Create Standard Invoice:

When you receive an invoice from the supplier, create one in your system.

Navigation: Payables responsibility > Invoices > Entry > Invoices

Enter the header details – Operating Unit, Trading Partner, Supplier Site, Invoice Date, Invoice amount (given the amount as 10000).

Click on Match button.

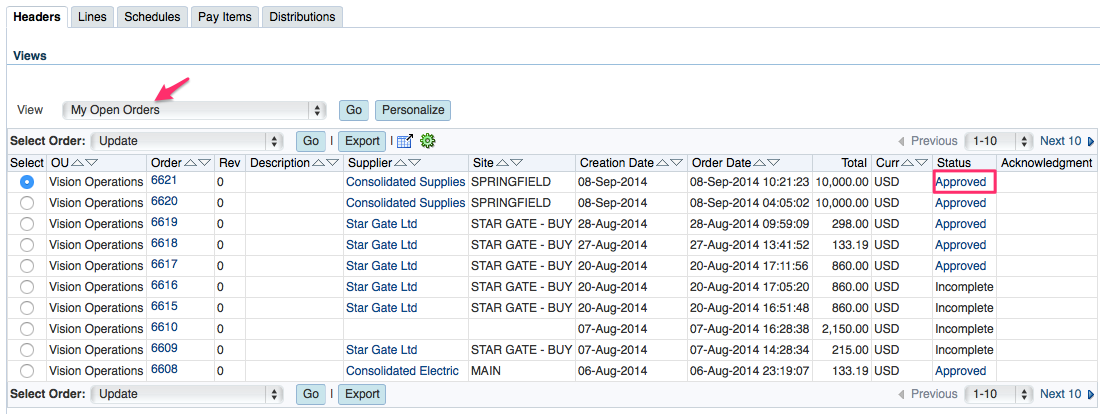

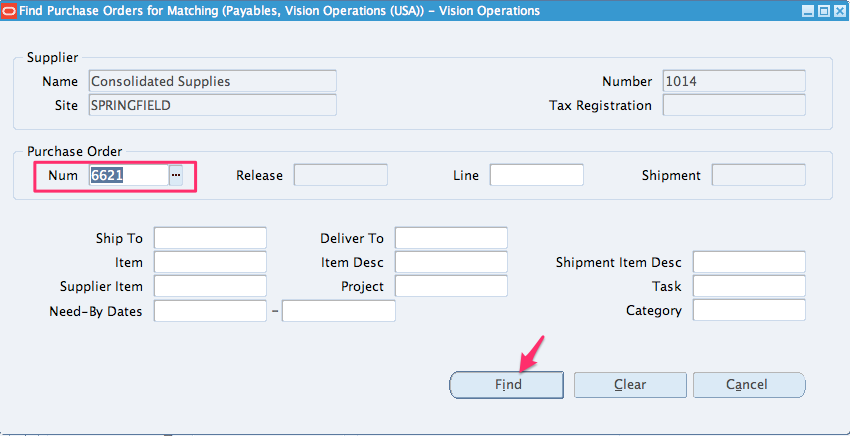

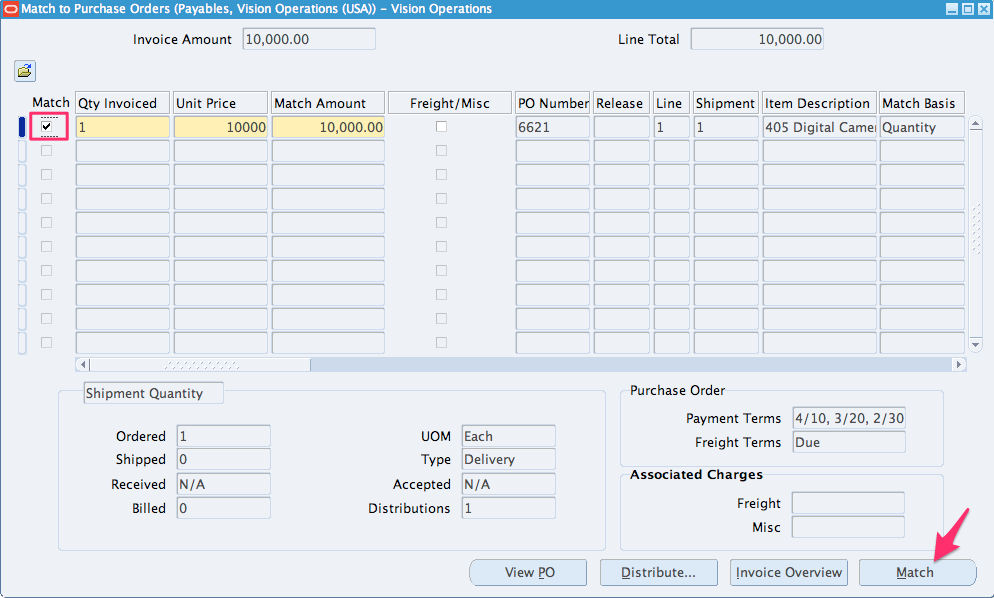

Enter the Purchase Order num as 6621 and click on Find.

Check the “Match” check box and click on Match button.

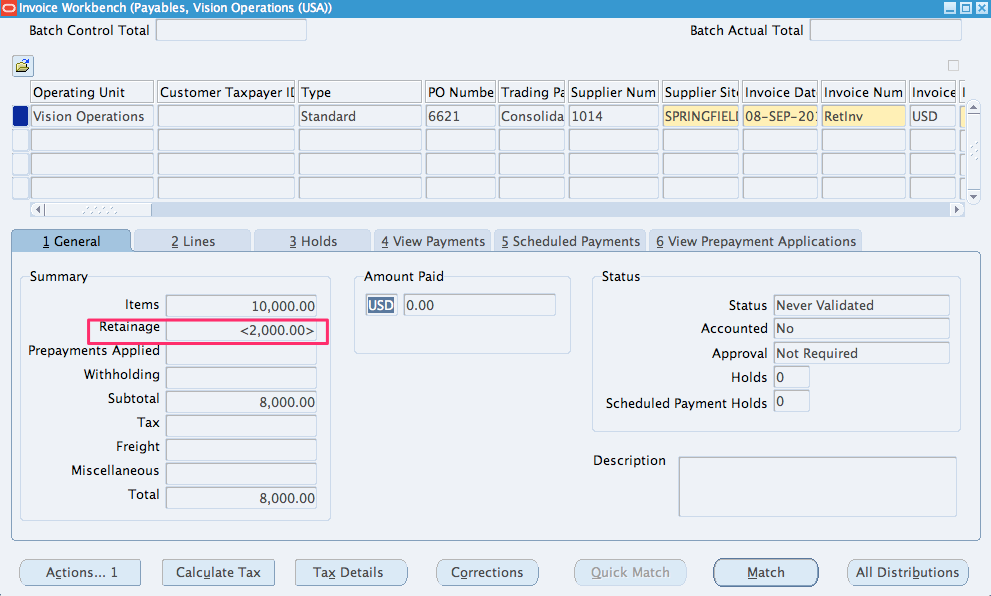

You will see that 20% of the invoice amount has been retained which means we will only pay the 80% of the invoiced amount.

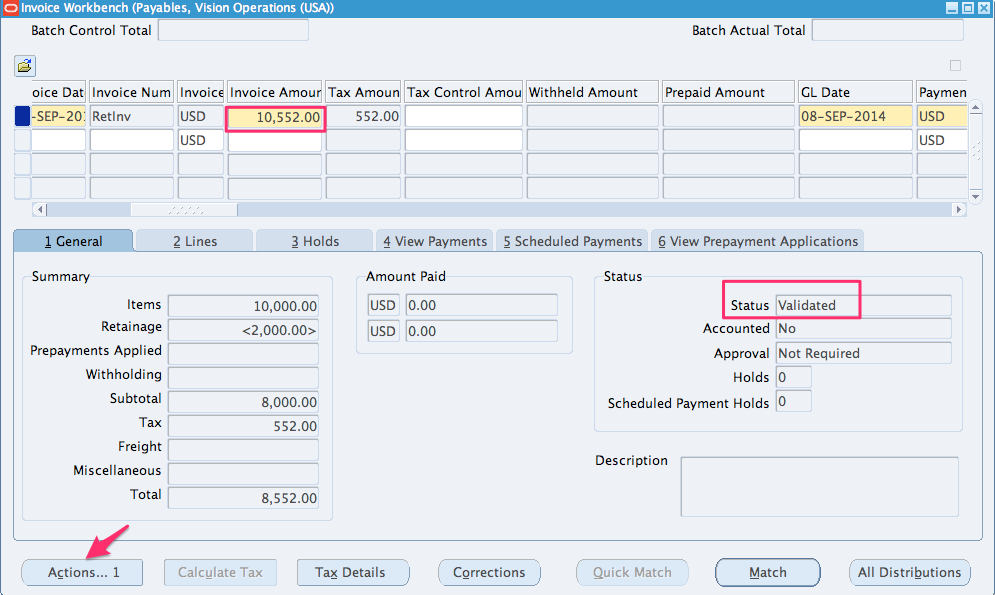

Now click on the Calculate Tax button. Adjust the invoice amount accordingly on the header and validate the invoice by going to Actions > Validate.

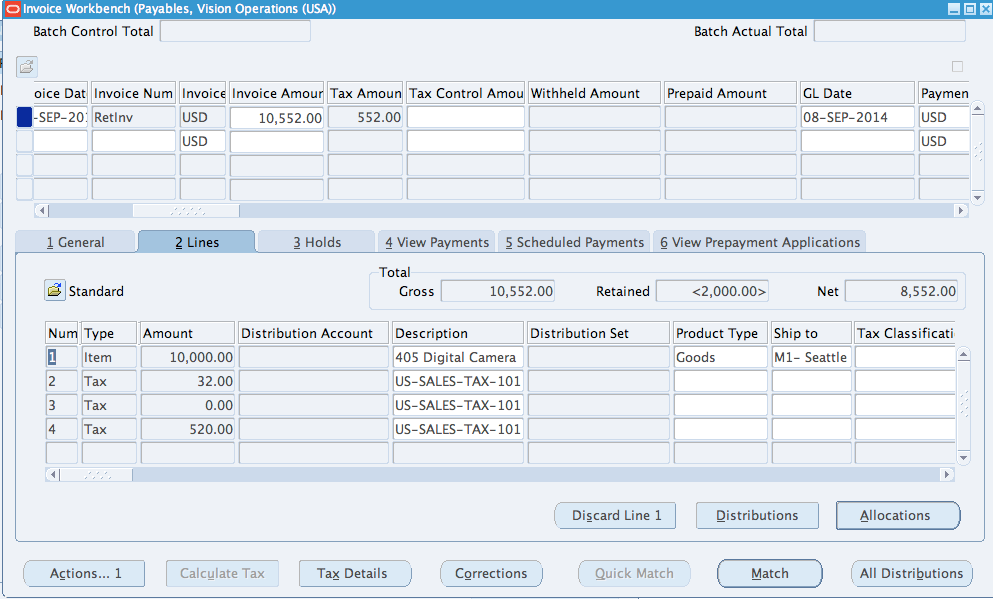

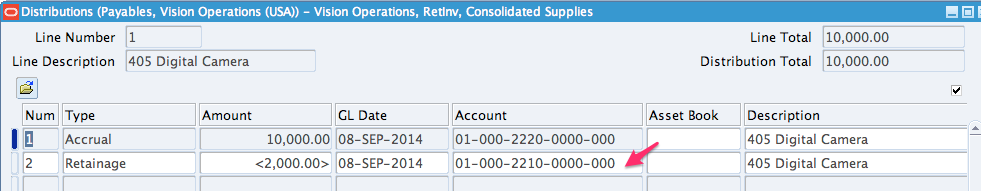

Look at the Line entries

Distribution entries:

The retainage account that we have defined in the pre-requisites section will be used here.

With this our standard invoice RetInv has been created and validated.

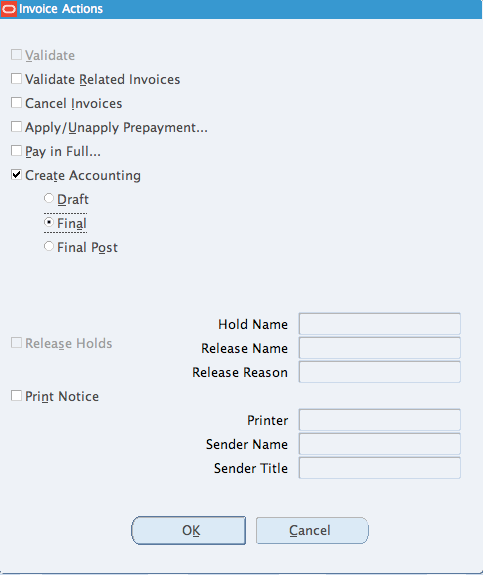

Create Accounting by going to Actions > Create Accounting. Choose Final Post.

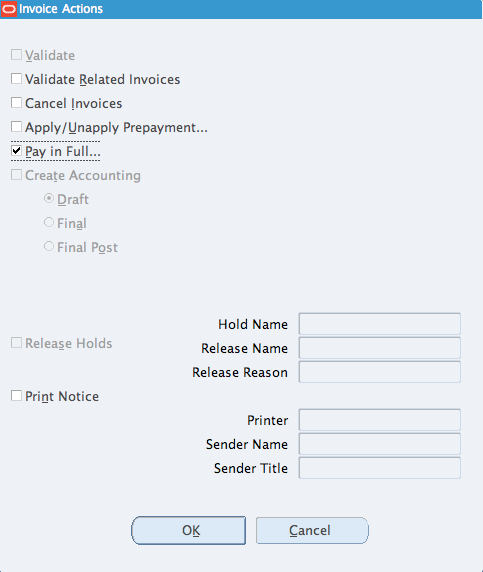

3. Pay the standard invoice.

Go to Actions > Pay in Full

Enter the payment Process profile and save. Payment of $8232 has been made after taking out the discounts. Remember even thought the total invoice amount is $10552, only 80% of it has been paid. 20% has been retained.

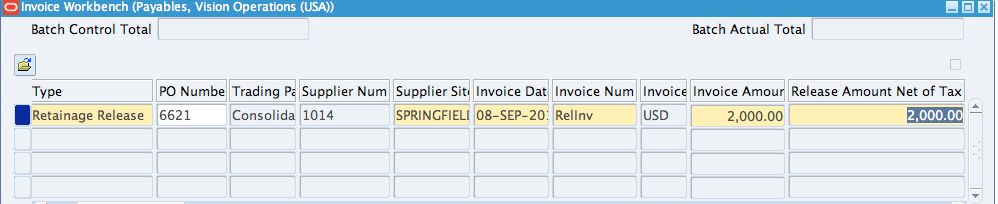

4.Create Retainage Release Invoice

Now when the entire work has been completed, we release the retained amount by creating a retainage release invoice.

Navigation: Payables Responsibility > Invoices > Entry > Invoices

Choose Invoice Type as Retainage Release.

Enter Supplier details, Invoice date and number.

In the Invoice Amount field, enter the amount that you will release + taxes.

Enter the retained amount without taxes in the field Release Amount Net of Tax

Save the work.

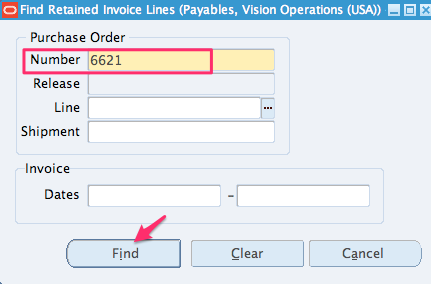

Now click on Match button and enter the PO num as 6621 and click on Find button.

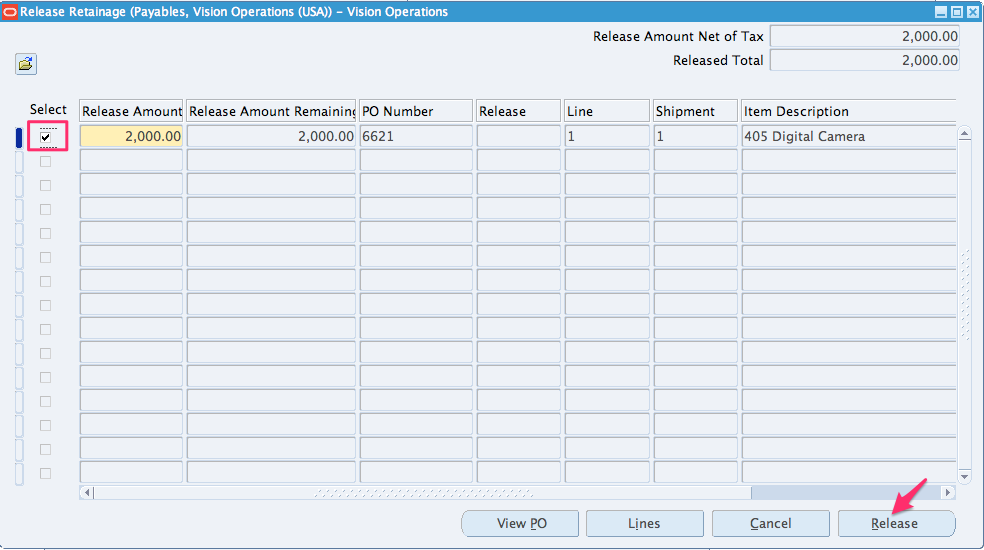

Select the check box next to Retained line and click on Release button.

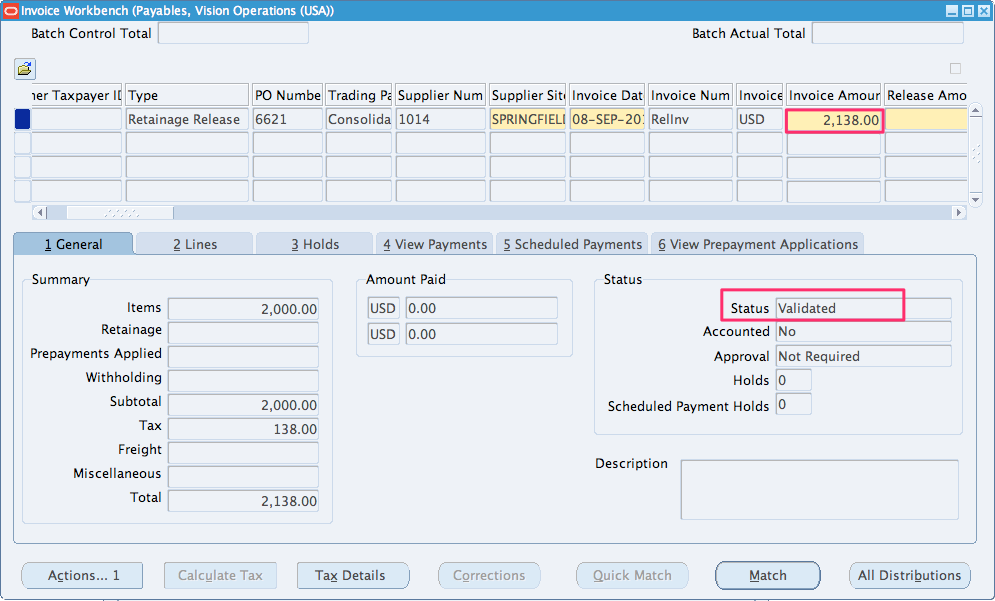

Now Calculate Tax. Adjust the Invoice amount to include the tax and validate it.

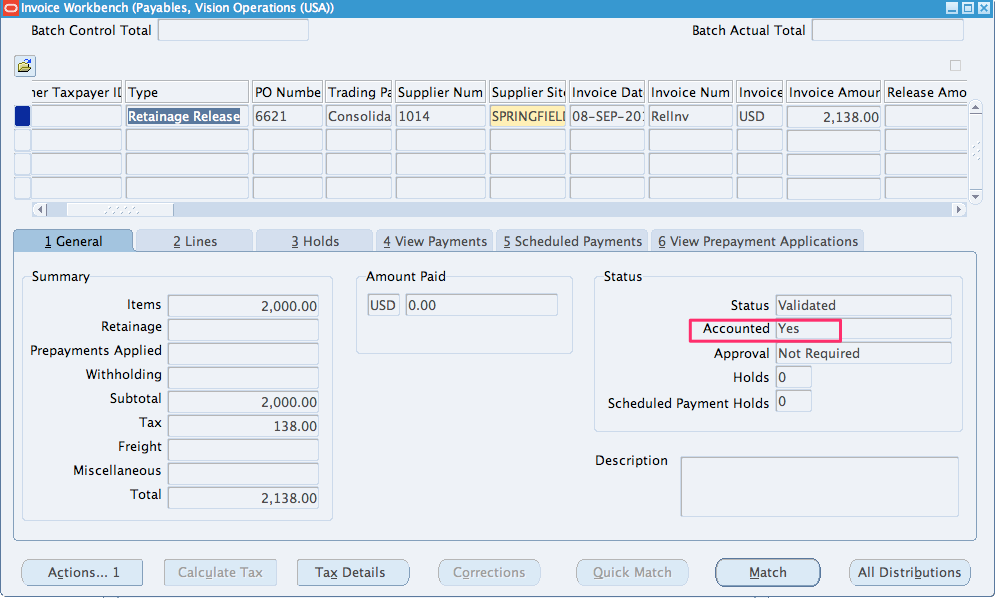

Kick off the Create Accounting process by going to Actions > Create Accounting > Final Post.

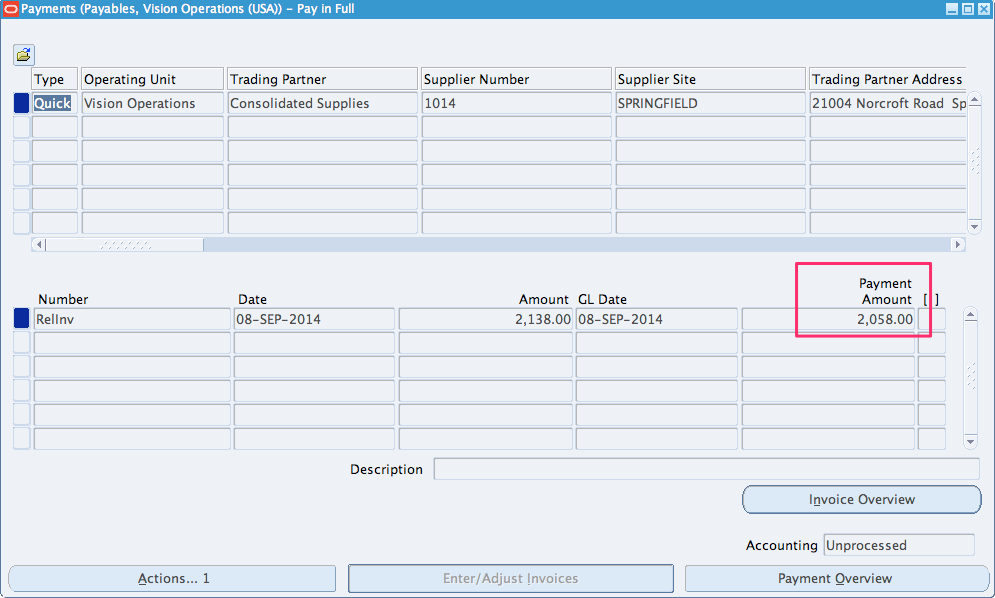

5. Pay the retained amount.

Go to Actions > Pay in Full.

Enter the payment Process profile and save. Payment of the retained amount + taxes has been made after taking out the discounts.

With this we have successfully retained certain amount and once the work is complete, we have released the retained amount to the supplier.